The Recreation Tax District Mystery: Youth Athletics vs. "Recreation Services"

In my previous video post about York County's proposed recreation tax changes, I mentioned three key questions I had for the county council. Today, I'm diving deeper into one of those questions:

Why are only youth athletics eligible for stipends, excluding senior, adult, special needs, and non-sport programs?

After some research, I believe I've found a partial answer - and it appears to stem from a fundamental misunderstanding of the Recreation Tax District's original purpose.

I have personally heard several people ask the county council this question in one form or another and most of the council members seem to gloss over the obvious fact that some of the municipalities offer a great deal of recreation programs for people of all walks of life, not only youth athletics. I asked the Parks, Rec, and Tourism department at Rock Hill and the answer I received was that in 2024 there were over 650 rec program activities, not including youth athletics.

The Ordinance

To understand the original intent of the Recreation Tax District, I turned to the York County Code of Ordinances, specifically section 35.170 "Creation and Establishment of the Recreation Tax District." This ordinance implements the 1994 South Carolina state law (Act No. 425) that authorized counties to create these special tax districts. Paragraph (C) clearly states the district's purpose:

(C) The Recreation Tax District is created and established for the purpose and function of providing recreation services in or for the residents of the unincorporated area of the county, and Council is hereby authorized to exercise all powers and to perform all functions and duties necessary or proper to the rendering of recreation services in the unincorporated area of the county.

I've highlighted "recreation services" because this broad terminology is significant. After reviewing the entire ordinance, I found no mention of "youth," "sports," or "athletics" anywhere. The language clearly refers to general "recreation services" without any limitation to specific demographics or activities.

Potential Explanations

Some might argue that while the ordinance itself doesn't specify youth athletics, perhaps later implementation guidelines or county policy decisions narrowed the focus. I've searched for such documentation but haven't found any official record that would legally restrict "recreation services" to youth athletics only.

It's also possible that when the district was initially implemented, youth athletics represented the greatest need, and this practice simply continued without being revisited. However, this historical practice doesn't align with the actual legal language establishing the district's purpose.

The Council Member's Perspective

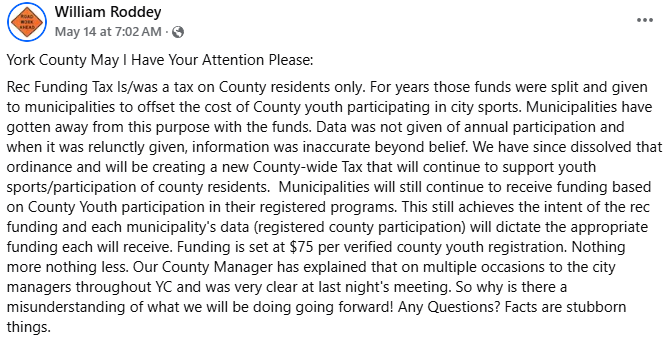

While researching this question, I found a revealing Facebook post from County Council Member William Roddey that offers insight into at least one council member's understanding:

In this post, Councilman Roddey states:

For years those funds were split and given to municipalities to offset the cost of County youth participating in city sports.

and continues by claiming:

Municipalities have gotten away from this purpose with the funds.

These statements suggest that he believes the original purpose of the Recreation Tax District was specifically for subsidizing youth athletics in unincorporated areas, and that municipalities have misused these funds by supporting programs beyond youth athletics. This perspective directly contradicts the broad "recreation services" language in the actual ordinance.

The Bottom Line

Based on my research, the answer to my original question appears to be a significant misunderstanding by some County Council members about the legal purpose of the Recreation Tax District. The ordinance clearly establishes a broad mandate for "recreation services" without limiting these to youth athletics.

This misunderstanding has real consequences. By restricting stipends to youth athletics only, the county has effectively excluded programs serving seniors, adults, people with special needs, and non-sport recreational activities - all of which seem to fall within the ordinance's intended scope of "recreation services."

As the Council considers abolishing the current Recreation Tax District and replacing it with a countywide tax, this is the perfect time to reconsider what "recreation services" truly encompasses and ensure that future funding supports the full spectrum of recreational needs in our community.

I've also tried to explain my perspective in this short video:

I'm still gathering information on this topic and would appreciate hearing other perspectives. Have you had experiences with recreation programs in our county that might shed light on this issue?